The Institute of Directors defines the role of the board as being “to ensure the company’s prosperity by collectively directing the company’s affairs, while meeting the appropriate interests of its shareholders and relevant stakeholders.” With such responsibility, it is essential that the board works to its full potential. This certainly includes knowing how to improve board effectiveness.

Worryingly, PwC found that only 10% of C-suite executives rated their boards as ‘excellent’ in terms of their effectiveness. The majority – 55% – said that their board’s performance was merely ‘fair’.

This article describes the steps required to improve board effectiveness and provides a checklist to help you assess how effective your board is.

What is board effectiveness?

Board effectiveness relates to the performance of the directors individually and collectively relating to their roles and responsibilities.

Once, stakeholders might only have been concerned with the profitability of the business, and that would have been the most important measure of board effectiveness. However, non-financial metrics are now similarly important, especially given the rise of investing decisions surrounding environmental, social and corporate governance (ESG) matters.

You can measure the effectiveness of a corporate board by monitoring its performance against those factors that matter most to the business and stakeholders.

7 steps to improve board effectiveness

Your board performing to the best of its ability is essential to the success of your organisation. These steps will help you increase the effectiveness of the board and help them lead the business towards its goals.

1. Clearly define roles and responsibilities

Your succession policy should allow you to select and prepare candidates who can fill the skill gaps on the board and ensure that the whole delivers more value than the sum of its parts. To facilitate this, create job descriptions for each board member, where you explicitly state what you expect of the director from their work with the board.

Following robust recruiting and succession processes, each director will have their own particular strengths and skills that they bring to the boardroom. This should be reflected in their clear, defined role on the board.

In addition to their duties, every member of the board must understand their key performance indicators (KPIs) and how they tally up with helping the business work toward its strategic goals and mission. For this reason, they should gain focus on what they need to achieve from their board work to contribute effectively to the governance of the organisation.

Directors can face legal sanctions for failing in their duties to the business and its customers. So, make certain that all board members understand the lines of accountability within the board environment. Having this framework in mind helps to make your workflows run more smoothly.

2. Examine board structure

Getting the structure of the board correct is a difficult balancing act, but it is essential for board effectiveness. There is no ideal board size that suits every company because it depends on your specific circumstances.

Think about the roles that you have defined. If there is too much overlap, your board might be too big. If you still have gaps or you require directors to work outside of their core skillset, you might need to recruit more board members.

You should also assess the committees that you have in place. Are they all serving a purpose and working efficiently and effectively?

Once again, look for overlaps and gaps. Just because you have always had certain committees, it doesn’t mean you should keep them if they are serving no purpose in driving the business toward its targets.

3. Revise formal operating procedures

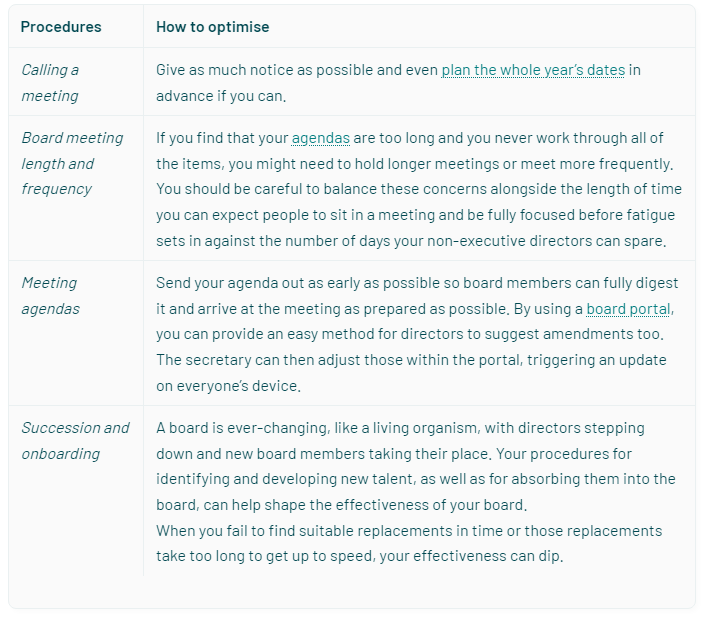

Another example of improving effectiveness by not being afraid to challenge traditions comes in the formal operating procedures of your board. You may well have run your meetings in a certain way for decades, but if it is not the most effective way possible, you should make a change.

Some of the procedures you can improve include:

4. Keep track of decisions and actions

There should be a frictionless procedure that translates decisions made into actions carried out afterwards. Sometimes this is not the case, and there is a disjointed approach.

Ensure that the chair communicates the action points that arise from decisions on key issues and that the directors responsible for those actions understand their obligations.

One way to achieve this is to track decisions and actions within your board portal. This acts as a clear guide to all board members, outlining the steps they need to take and by when they need to take them. It ensures everyone knows their responsibilities and can be held accountable for completing their tasks within the deadline. This means that the board takes effective action to bring its decisions to life and carry out its duties.

5. Evaluate board composition

There are a number of different considerations to make with regard to board composition. You need a balance of skills, experience, outlooks and attitudes. In addition, gaining better board diversity in terms of gender, race and other considerations helps you to avoid groupthink that fails to fulfil the potential of the business.

The better the balance, the more your board members can challenge each other knowledgeably. They can offer innovative solutions, making for a better-informed debate and stronger decision-making.

Use board evaluations to identify gaps in the board of directors and look to fill them with the help of your succession planning process.

6. Understand board culture

The culture of the board has a bearing on its effectiveness. Are the meetings too formal or too informal? This is an element of board culture that could determine how effective those meetings are.

In addition, a culture of development shows a board is willing to commit to change and adapt to new ways of working if they will benefit the organisation. If this is not the prevalent culture, it will rarely be able to be as effective as possible.

During a meeting, the chair has a key role in setting the board culture. If they allow the big characters in the room to dominate, it will skew the debates that happen within the board. By bringing in quieter board members and balancing the discussion, board chairs can shift the culture and gain the benefit of additional viewpoints.

7. Engage board members

The chair or CEO can improve the effectiveness of the board by making efforts to engage board members. This could include reaching out between meetings to develop personal connections, organising informal meet-ups to encourage team building, making time to celebrate wins and other such exercises.

These activities develop a connection between the board members, encouraging them to give more of themselves to their work on the board and increasing the effectiveness of the board at the same time.

Checklist to assess board effectiveness

Useful questions to ask consider when assessing board effectiveness include:

- Does the board have an appropriate environment and a diverse mix of skills, experience and independence?

- Does the organisational design support and/or enable strategic decision-making?

- Do board members understand their roles and responsibilities?

- Are individual directors formally evaluated in terms of their performance?

- Does the chair create an open and inclusive environment at meetings where all are encouraged to contribute?

- Is the chair’s performance appraised by their directors?

- Are management boards clear on their roles and responsibilities?

- Does the board have clear and timely access to information to assess both the performance of the business and its management of strategic risks?

- Are board papers distributed in a timely manner?

- Do directors engage with the reports, agendas and other documents they receive?

- What percentage of actions are completed on time?

- Does the board provide a plan for its succession?

- Are diversity and training considered in succession planning?

FAQs

How do you structure board meetings?

Board meetings should have a clear agenda to allow directors the opportunity to prepare thoroughly for the meeting. This will include the approval of the minutes, reports from officers and committees, special orders, unfinished business from previous meetings, new business and announcements.

What is considered effective governance?

A board shows effectiveness by creating and developing policies it believes are in the best interests of the company and its key stakeholders. Effective governance helps the board reach its strategic goals and face future challenges with confidence.

What is the biggest challenge to board effectiveness?

A disengaged board can be detrimental to the effectiveness of its work. Board members need to give their full attention to their role, including preparing for and following up after meetings. Without full commitment, board performance is affected, meetings are not as productive as they could be, and the board could fail to execute its decisions.

Conclusion

When you look at how to improve board effectiveness, engagement is one of the key drivers. When board members feel engaged with their work and they know their roles and expectations clearly, they can dedicate their time most efficiently. Communication helps achieve that, and a board portal is an effective way to facilitate it.

Source: ibabs.com