Digital transformation has changed the face of every industry. Companies in this trend must strive for the ultimate digital experience and meet the ever-changing consumer demands.

Companies (irrespective of size) underwent strategic shifts in this transformation process. Some have skyrocketed with trends, some have entered into technology mergers and acquisitions, and some have ended up in shackles.

Companies (irrespective of size) underwent strategic shifts in this transformation process. Some have skyrocketed with trends, some have entered into technology mergers and acquisitions, and some have ended up in shackles.

Although businesses have long understood the value of digital transformation’s future, other priorities sometimes take precedence over it. On the other hand, prioritizing digital efforts has emerged as one of the most critical business enablers for success in a world of rising competition.

In 2023, the field of digital transformation showcases an overwhelming adoption rate, with over 90% of organizations engaging in various digital initiatives, emphasizing the pervasive nature of digitization across industries (Source: Gartner). This shift is further underscored by the fact that a mere 23% of businesses find themselves without any dependency on digital operations or products, highlighting the widespread integration of digital technologies into the core of organizational processes (Source: Forrester).

Digital transformation is no longer merely a strategic choice but a business imperative, as expressed by 27% of managers who recognize it as crucial for survival in the competitive market (Source: IDC). The investment and spending trends in digital transformation are equally noteworthy. Direct investment in digital transformation is projected to soar to an impressive USD 7 trillion, reflecting a robust CAGR of 18% from 2020 to 2023 (Source: IDC).

The economic repercussions of this shift are significant, as organizations undergoing digital transformation are expected to make up over 50% of the global GDP by 2023, totaling an approximately USD 53.3 trillion (Source: Research and Markets). The digital transformation market is set to experience substantial growth, with a projected CAGR of 23% between 2019 and 2025, reaching a market value of USD 3.3 trillion (Source: IDC).

As organizations prioritize their digital transformation strategies, key trends emerge. Seventy percent of surveyed organizations identify leveraging technology to simplify workflows and manual processes as their top priority, indicating a focus on operational efficiency (Source: Quixy). Moreover, the driving forces behind digital transformation efforts are diverse, with 51% originating from growth opportunities and 41% spurred by increased competitive pressure (Source: Prophet).

Looking ahead, while the Internet of Things (IoT) dominated the digital transformation market in 2019, Virtual Reality (VR) and Augmented Reality (AR) technologies are predicted to experience the fastest growth until 2025 (Source: Research and Markets), showcasing the dynamic and evolving nature of technological priorities within the digital transformation strategies.

In 2024, a significant trend in the digital transformation journey will be the expanded use of automation technologies. Similarly, effective use of cloud technologies, low-code/no-code tools, hyper-automation, AI, and other technologies would greatly aid company scaling.

Hybrid work, intelligent search, Customer data platforms (CDPs), AIOps and machine learning, and platforms that link Agile, DevOps, and ITSM are some of the most recent advancements in digital transformation technology.

Media and entertainment saw a rapid transition due to the trend of digital transformation managed services. Amid interactive video ads and content-driven strategies widened social media and other internet platforms, the media and entertainment industry has seen the proper form of digital transformation strategies in recent years.

Every industry, including media and entertainment, is following this path. In parallel, consumers are demanding more content in more unique ways!

Before going in-depth about the digital transformation trends in 2024, we need to know the future of digital transformation.

What is Digital Transformation?

Digital transformation solutions use technology to generate new customer experiences, cultural norms, and business practices. It entails utilizing cutting-edge technology to modify corporate strategies for the digital era.

The digital transformation strategies aim is to shift the focus away from sales, marketing, and digital transformation customer experience services and toward the actual customers, in contrast to previous attitudes and methods. As a result, over the past 10 years, customers have received significant priority when developing corporate goals, and businesses now base their goals on what customers need.

The paper must be replaced with online and mobile apps as part of a digital transformation strategy. As a result, it is more organized, tidier, sustainable, and environment-friendly.

The shift to digital requires data protection. For instance, team members organize everything in a secure cloud that they can easily access instead of sending spreadsheets or physical notes.

Why is the Digital Transformation Essential?

Now that you know the purpose of digital transformation solutions, why should your company adopt its trends? You can better appreciate why you should care about the digital transition by considering the following arguments:

1) It’s a Modern Requirement

We live in a contemporary digital environment; thus, you should be concerned about digital change. Organizations must adjust to the top digital transformation trends in manufacturing to stay competitive as they transition from a traditional to a modern environment.

Tools and methods should evolve as circumstances do. Let’s face it: 30-year-olds cannot ride the same bicycle they did when they were five since it is no longer appropriate for their physical needs.

It also applies to welcoming the digital revolution in the modern day. Organizations must implement the newest technology that best meets their requirements.

2) Enhancing Client Satisfaction

Another reason to be concerned about digital transformation strategies is that client happiness increasingly defines company outcomes. Organizations now run digitally and use new technologies to do more in less time and give clients better service.

You can follow the development of successful businesses and see that they have appreciated their users through time. Due to increased market rivalry, consumers favor businesses that respect their needs. You may learn more about your audience and determine what is ideal for them by utilizing technology that makes it easier to care about users by storing their data in the cloud. After that, you may use that information to tailor your goods and services to their needs.

3) It Facilitates Team Collaboration

Additionally, digital transformation service providers include internal interactions like communication and teamwork among staff and exterior connections. Artificial intelligence can be used to build effective communications within your firm, regardless of business models or company size.

Businesses may utilize digital solutions to coordinate their team members and ensure that each assignment is completed by the deadline. This makes team members more productive, enables them to work together, and allows them to communicate more efficiently.

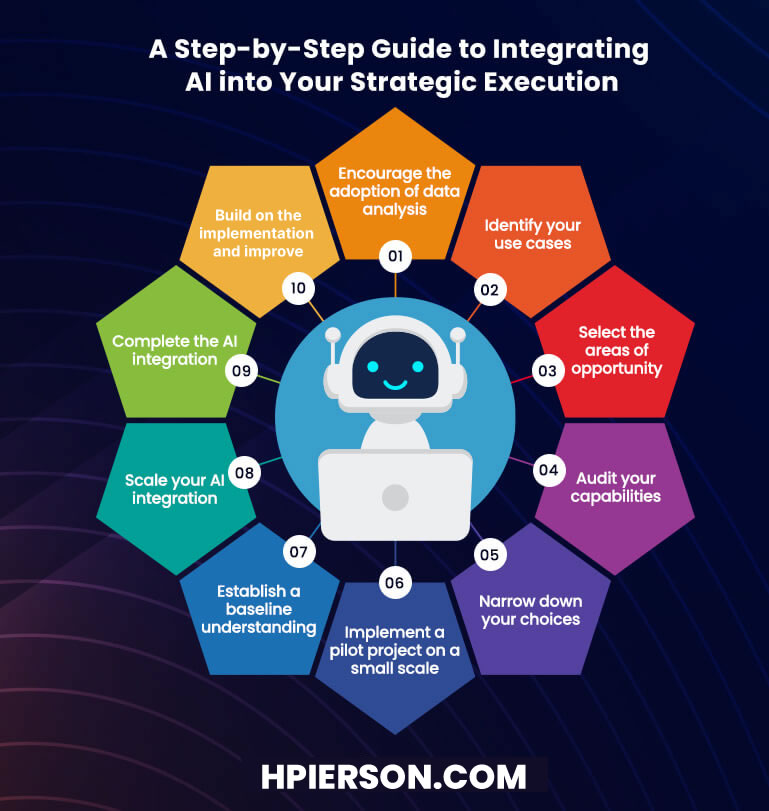

Top 10 Essential Digital Transformation Trends for 2024:

1) AI for Cutting Down OPEX

One of the leading surveys shows that the media and entertainment industry is witnessing enormous spending and ending up with fewer profits. The industry’s operational expenditures (OPEX) exceed profit margins. The spending goes beyond control in running for early profits or gaining a competitive edge. Precisely at this juncture, the industry should rethink its strategy.

It’s time to recheck the way they handle content and spending abilities. And AI and Machine Learning (ML) are right in front to show the way! AI and ML techniques help you smartly use content and spending.

Now, the focus should ideally be on how effectively the content should be utilized rather than creating it for content’s sake. AI can eventually help you cut down OPEX.

2) Privacy and Trust

Privacy and trust are the two essential aspects that will decide organizational progress in the digital transformation services journey.

One global survey involving more than 4000 brands and consumers found that 61% of brands admitted to losing consumer trust by failing to protect their data and information. This is an increasing gap between consumers and brands that brands need to focus more on to progress. Traditional media was reportedly among the top three distrusted industries besides social media and government.

Given this fact, the future will involve maintaining the visibility of consumer data and delivering the best user experience with the collected data. Data regulations have already supported such measures, and more are expected.

3) Enterprise Resource Planning

Technology is often the first thing that comes to mind when discussing successful digital transformation services. But that might not always be the case.

Digital Transformation service providers are more about implementing a new culture within an organization. It’s a combination of people, processes, and technology. So, instead of building effective media arms or channels to promote services, the organizations should equally focus on building intelligent Enterprise Resource Planning (ERP).

ERP can help reduce spending, improve resource efficiency, and enhance productivity. While you might have already invested in technology and tools, it is time to focus on your back-office operations for continuous refinement to see measurable results and high profitability.

4) Personalization

Personalization of services will be a vital factor in deciding an organization’s digital transformation services companies’ success in 2024 and beyond. No content for free or content for all! The more innovative the approach, the brighter the results will be. So, organizations must personalize their approach to draw the best from their consumers instead of just pushing some content for traction.

Termed ‘smarter personalization,’ this approach is not just for content. It should be reflected everywhere, whenever the brand meets the customer! This will be crucial for successful digital transformation and customer relationship management.

Given these four trends, one can estimate the transition the digital transformation ideas consulting services trend will likely bring to the industry’s functioning.

No doubt, 2024 is going to be a different ballgame together for digital transformation services.

5) Connected User Experience

The average number of applications used in an organization is increasing rapidly. Consumers expect consistency as they traverse multiple channels, such as messaging or mobile service portals.

Given this requirement, offering a connected experience is the need of the hour for companies as part of their digital transformation ideas consulting services efforts. Omni-channel customers with better-connected experiences were found to stay online longer than single-channel customers.

Connected experience means enabling customers with improved and easy accessibility anywhere and anytime. As the surveys find, while an average of 900 applications in an enterprise, only 29% of them can offer a connected experience.

6) Data-driven Business

Data is undoubtedly the heart of the future of digital transformation services companies. Unlocking and analyzing data potential has become crucial to driving business, streamlining operations, and launching new products and services.

Adequate movement of resources and easy flow of operations across organizations are primarily attributed to effective data utilization.

7) Multi-cloud Utilization

Most enterprises today operate on multi-cloud environments. However, managing multi-clouds, especially when moving workloads between clouds, is one of the prime challenges. API-led development and containers offer solutions to this problem.

APIs help unlock the unique functionalities of applications residing in multi-cloud environments. Containerization has also been a proven solution to address concerns with multi-cloud environments.

Get multi-cloud to achieve better results in your digital transformation ideas managed services journey.

8) Effective IT

The IT department is a core enabler of any business today. It helps tap the full potential of technology to deliver more through effective and proper decision-making regarding utilizing emerging technologies. So, to succeed in the digital journey, organizations need to scale beyond their current IT capabilities.

9) Partner Ecosystem

Engaging in strategic partnerships becomes crucial for any organization as the business expands. Successful businesses have already begun building a collective ecosystem of external partners, stakeholders, and customers.

This partner ecosystem helps digital businesses transform in the seamless incorporation of products and services into the customer experience.

10) IoT and 5G

The fifth generation of mobile network technology is known as 5G. Some of 5 G’s essential traits include multi-peak data speeds, minimal latency, a better user experience, better connectivity and availability, and increased network bandwidth.

Edge computing and 5G can result in some fascinating advances. For instance, IBM will provide Verizon and Telefonica with cloud services to power 5G networks.

In turn, automation of routine jobs will prevent network problems using technologies like artificial intelligence (AI), drone-initiated inspections, and video inspections.

Source: veritis.com